Award-winning PDF software

How to prepare Guarantor Form

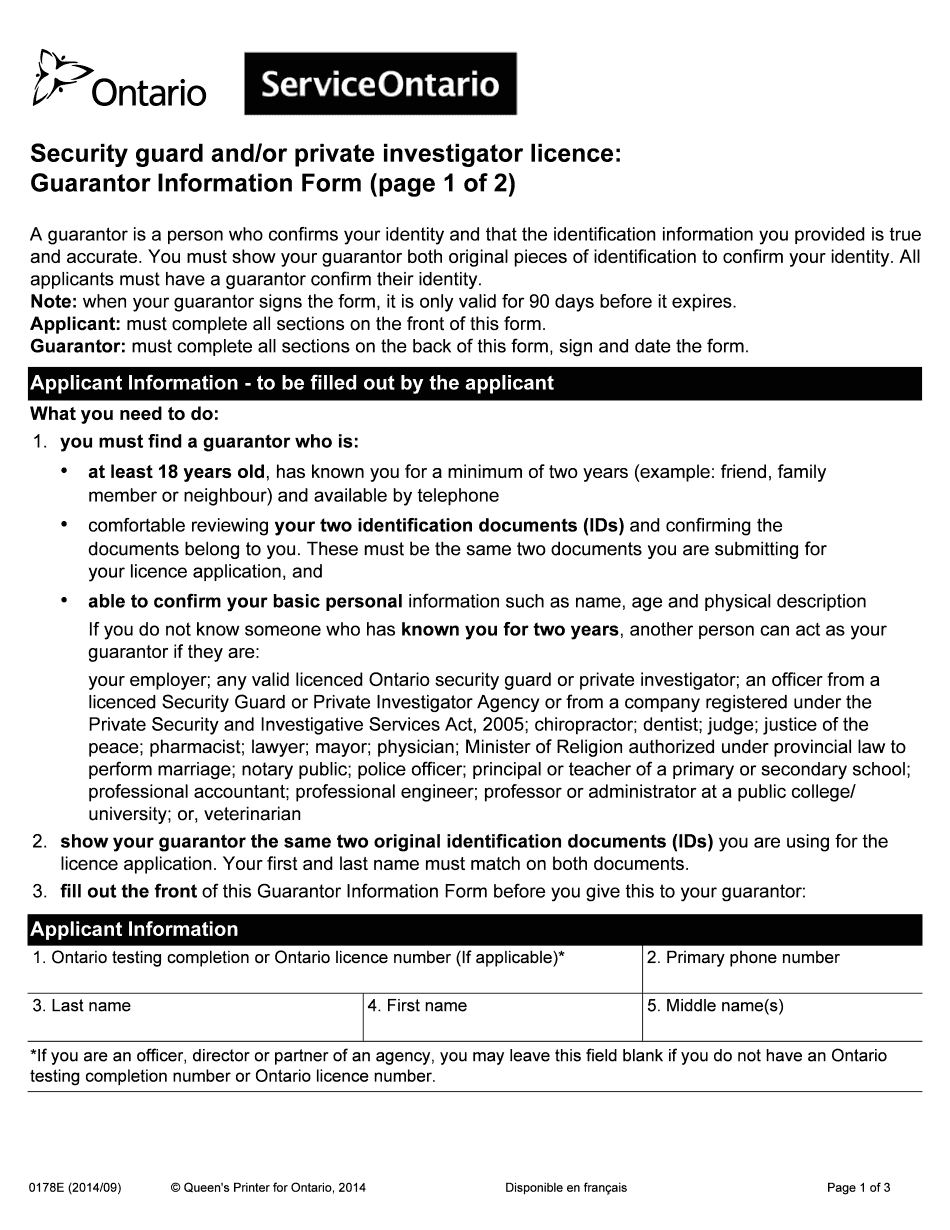

About Guarantor Form

A guarantor form is a legal document that is used to confirm the financial responsibility of a third party, known as the "guarantor," in case the primary borrower defaults on their obligations. This form serves as a contract between the lender and the guarantor, outlining the terms and conditions of the guarantor's liability. A guarantor form is typically required by lenders or financial institutions when a borrower lacks sufficient creditworthiness or financial stability to secure a loan or rental agreement on their own. In such cases, the lender may ask for a guarantor who will be responsible for repaying the loan or fulfilling the terms of the agreement if the primary borrower fails to do so. Some common scenarios where a guarantor form is needed include: 1. Student loans: Many students, especially those without a credit history or steady income, may need a guarantor to approve their student loans. 2. Rental agreements: Landlords often ask for a guarantor when leasing properties to tenants with limited rental history or unstable income. 3. Personal loans: Individuals with a weak credit score or insufficient income might need a guarantor to secure a personal loan. 4. Small business loans: Entrepreneurs or small business owners without strong credit or assets may require a guarantor to obtain a loan for their business. It is important to note that being a guarantor holds significant financial responsibility, and therefore, it is crucial for both the primary borrower and the guarantor to fully understand and evaluate their obligations before signing a guarantor form.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Guarantor Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Guarantor Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuation.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your Guarantor Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Guarantor Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.